Discover the ultimate guide to leveraging STC PAY for seamless money transfers and beyond. STC PAY revolutionizes financial transactions with its versatile features, ensuring users can effortlessly send money locally to friends & Family and internationally. Whether transferring funds to family overseas or paying bills at home, STC PAY offers convenience at your fingertips.

Introduction to STC Pay

What is STC Pay?

STC PAY is a digital Wallet usually called E-Wallet in Kingdom of Saudi Arabia (KSA) & Bahrain. Recently the Saudi Arabian Monetary Agency (SAMA) approved STC Pay becoming STC BANk in KSA

Features of STC Pay

- International Remittance

- Instant Transfers with Western Union

- Competitive Pricing and Benefits

- Notification and Security Features

- Local Bank Transfer

- Steps for Local Bank Transfers

- Transfer Fees and Process

- Holiday Transfers

- Wallet-to-Wallet Transfers

- Ease of Use

- Security Measures

- Transaction Limits and Benefits

- Purchases with STC Pay

- Payment Options

- Merchant Acceptance

- QR Code Payments

- Bill Payments

- STC Bill Settlement

- Tracking Features

- Security Measures

- SAWA Recharge

- Mobile Recharge Process

- Monthly Recharge Options

- Convenience and Security

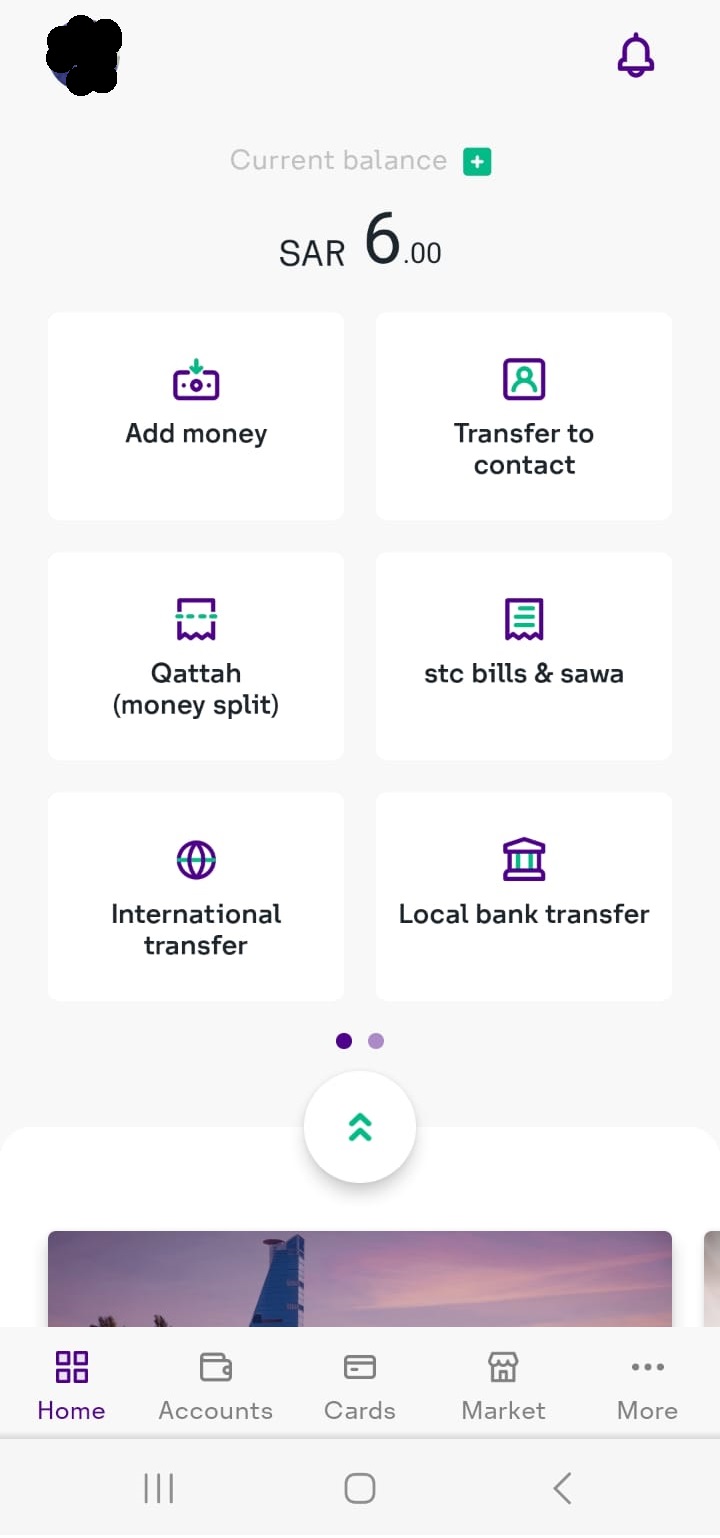

How to Transfer Money to Friends & Family Via STC Pay

1. Click Transfer to Contact

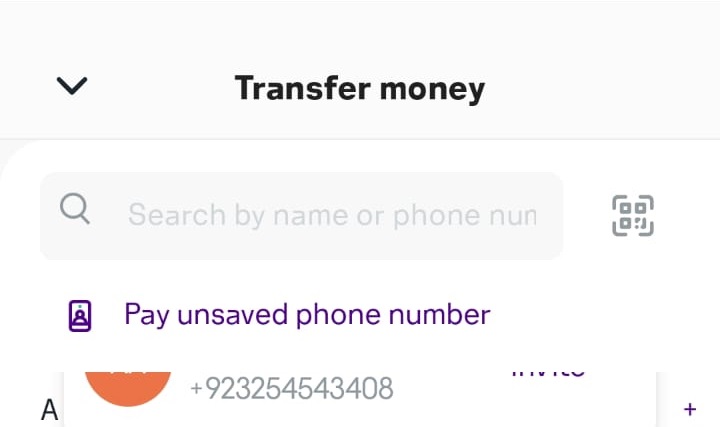

2. Select the contact you want to send money from the contact book or Click “Pay Unsaved Phone Number”

3. Enter the Amount Mobile Number & purpose of transfer & additional notes if needed but it’s optional.& click confirm. You will receive OTP ( One Time Password ) & enter it into the application & Transfer will be completed for Local STC Transfer.

Steps to Transfer Money Internationally

- Setting Up Your Account

- Selecting Transfer Options

- Verification and Confirmation

Local Bank Transfer Process

- Adding Bank Accounts

- Initiating Transfers

- Confirmation and Receipts

Conclusion

STC Pay simplifies financial transactions with its comprehensive range of features, ensuring secure and convenient payments for users across various needs. You have all the futures of stcPay payment solutions with a real bank (yes stcPay is a real bank now not a Digital bank only)

FAQs About STC Pay

1. Is STC Pay safe to use for transactions? STC Pay ensures robust security measures, including encryption and transaction verification, making it safe for all financial transactions.

2. Can I use STC Pay for international transfers outside Western Union? STC Pay supports international transfers through various partners, ensuring flexibility beyond Western Union.

3. How long does it take to transfer money using STC Pay locally? Local transfers through STC Pay are usually processed instantly, even during holidays, ensuring quick access to funds.

4. Are there any fees for using STC Pay to pay bills? STC Pay may charge nominal fees for bill payments, depending on the biller and the service opted for by the user. For bank transfers, STC pay charges of 5.5 SAR for each Transfer.

5. What are the benefits of using STC Pay for SAWA recharge? STC Pay offers seamless SAWA recharge options, ensuring hassle-free mobile prepaid recharges directly from your digital wallet.