For online businesses, e-commerce sellers, and non-resident LLCs, Texas sales and use tax requirements can seem overwhelming. As an Amazon seller or a non-resident LLC, understanding your obligations is critical, especially if you exceed the Texas economic nexus threshold of $500,000 in annual sales.

This guide provides an end-to-end walkthrough of sales and use tax filing, focusing on Amazon sellers, non-resident LLCs, and IT service companies. Whether you’re selling physical products or digital services, following these steps will help you stay compliant in the Texas SOS Comptroller Filing.

This guide will help you with every aspect of tax filing in Texas, from getting a sales tax permit to reporting your sales online on the Texas Comptroller’s website.

Texas Sales Tax for Amazon Sellers and E-Commerce Businesses

For Amazon sellers and other e-commerce businesses, Texas sales tax obligations ( Aka. tax nexus threshold ) begin once your annual sales to Texas residents exceed $500,000. If less than that, you are not required to get a sales & use tax certificate. Meeting this economic nexus threshold means you must register, collect, and remit Texas sales tax even if you don’t have a physical location in the state & you are a Remote seller.

How Amazon Sellers Should Manage Sales Tax Collection

Amazon collects and remits sales tax on behalf of se in most of the states, Amazon, eBay, Walmart Marketplace, StubHub, and Etsy. Marketplace providers that are engaged in business in Texas must collect and remit tax on all sales by marketplace sellers. The local tax rate is based on the shipping destination in Texas.

Amazon sellers must:

- Set Up Texas Tax Collection: In your Amazon Seller Central account, ensure that the tax settings are configured to collect Texas sales tax.

- Understand Marketplace Facilitator Laws: If you sell on multiple platforms (lke Etsy, and eBay), verify which ones collect and remit tax on your behalf and which don’t.

- Keep Records of All Texas Sales: Sales tax filings require precise data. Maintain records of each sale to Texas buyers, including product prices, tax rates applied, and total TikTokllected if you are doing Tiktok Shop, Dropshipping & generating sales the Shopify website ( your own website).

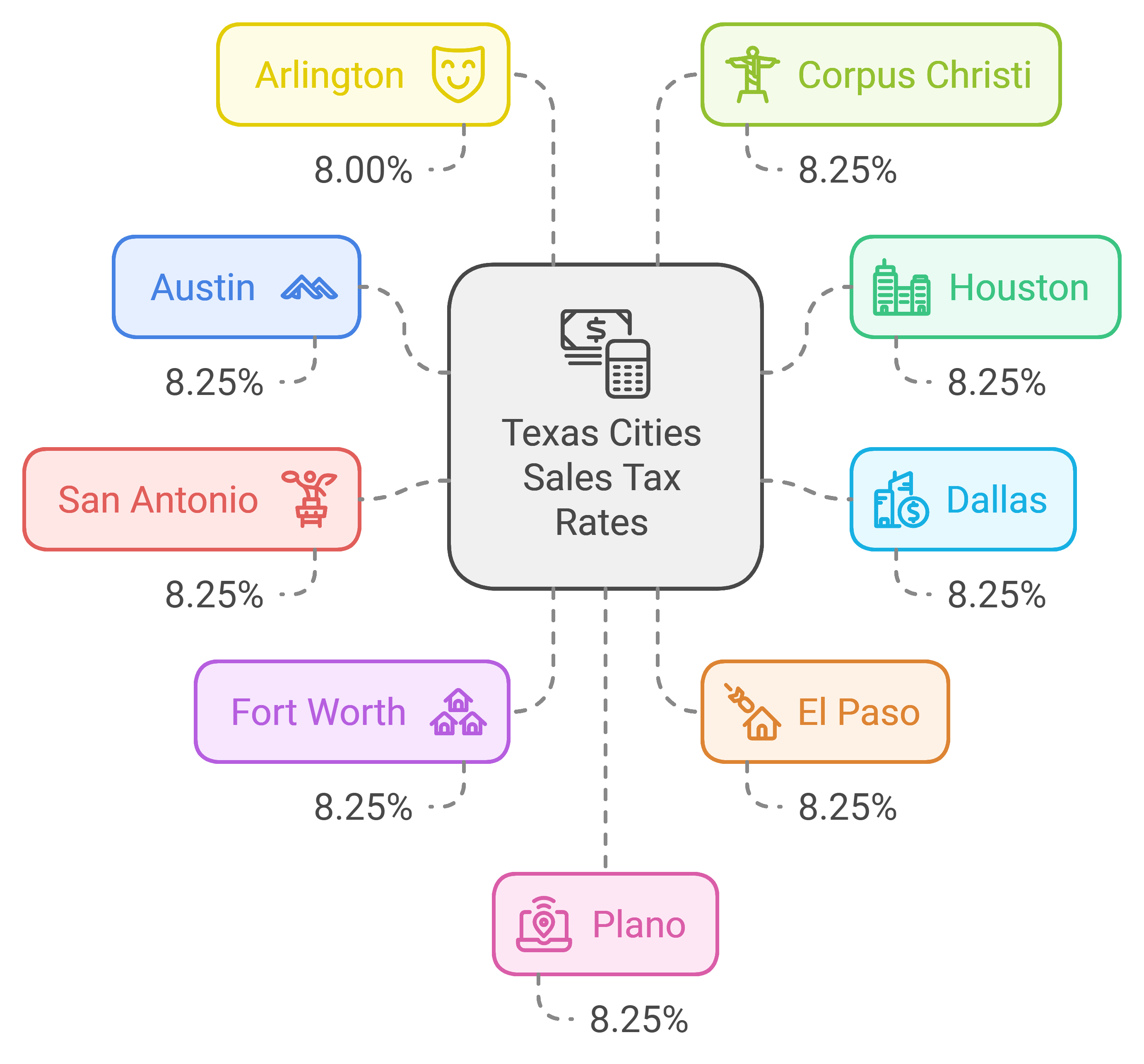

Determining Sales Tax Rates for E-Commerce Sales

Sales tax rates in Texas vary by location. Use the Texas Comptroller’s Sales Tax Rate Locator to find the correct rates for each sale based onYouYoue buyer’s shipping address. you can also use Google Maps to find exact locations & also download files to search tax rates for your Area. Since online sales often involve multiple tax jurisdictions, this step is essential.

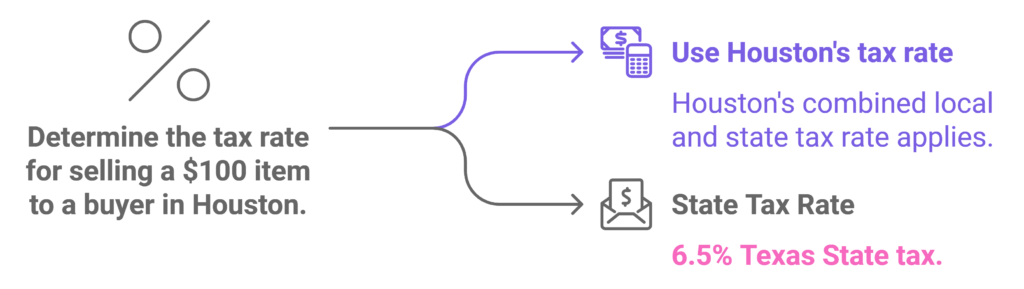

- Example Calculation:

If an Amazon seller in Austin sells a $100 item to a buyer in Houston, the tax rate would be Houston’s combined local and state tax rate. Multiply the item’s sale price by the rate to find the total tax owed.

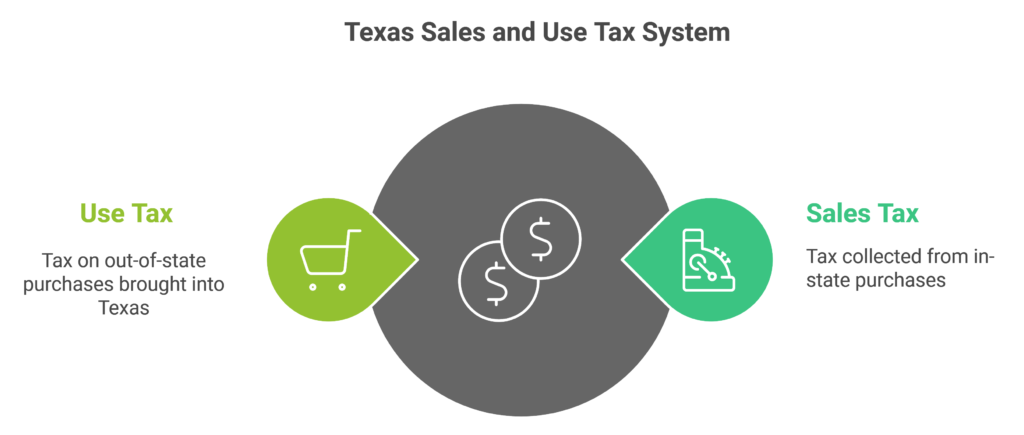

Understanding Sales and Use Tax in Texas

Texas imposes both sales and use taxes on retail sales, leases, and rentals of most goods, as well as certain services. While both taxes ultimately serve to collect revenue for the state, they apply in slightly different scenarios:

- Sales Tax: Collected from Texas-based customers during the sale of taxable goods or services.

- Use Tax: This applies to taxable items bought out-of-state but brought into Texas for use, storage, or consumption.

Both taxes apply to businesses that meet certain sales thresholds or physical presence standards in Texas.

Key Differences Between Sales Tax and Use Tax

- When It Applies: Sales tax is collected at the point of sale, while use tax applies when an item is bought outside of Texas and brought into the state for use.

Filing Sales and Use Tax for Non-Resident LLC Owners

Non-resident LLCs are subject to Texas’s sales tax regulations if they meet the economic nexus threshold. This rule applies whether you’re selling physical goods, software, or digital services to Texas residents. Here’s a guide for non-resident LLCs:

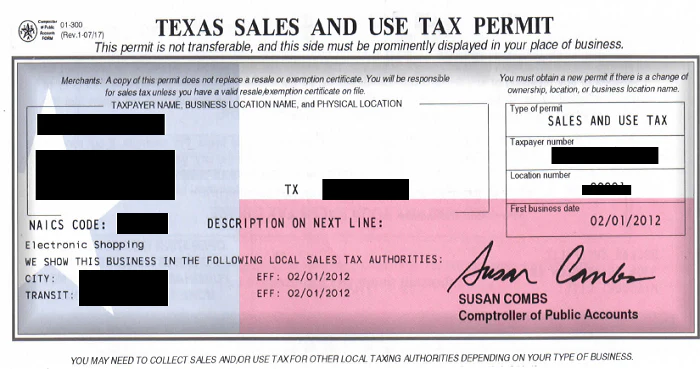

How to Obtain a Texas Sales and Use Tax Permit

A sales tax permit allows businesses to legally collect sales tax from customers in Texas. Here’s how to obtain one:

- Visit the Texas Comptroller’s Office Website: Go to the Texas Comptroller’s tax section and select Apply for Sales Tax Permit.

- Complete the Application: Enter information about your business structure, physical presence, and expected sales.

- Submit Required Documents: Some businesses may need to submit proof of identification or business registration documents. Check the Comptroller’s requirements carefully to avoid delays.

- Approval Process: Once the application is reviewed, you will receive your Texas Sales Tax Permit. Keep this permit on file, as you’ll need the permit number for filing sales tax returns.

Sample of Sales & Use Tax

- Determine Taxable Goods and Services: Identify whether your products or services are taxable. For example, digital goods, software as a service (SaaS), and certain online services can be taxable in Texas.

- Collect the Correct Tax Rate: Use the buyer’s location to determine the local sales tax rate for each transaction. Keep detailed records, as Texas’s complex local tax structure makes accuracy critical.

- File Regular Sales Tax Returns: Depending on your LLC’s revenue, you may need to file monthly, quarterly, or annually. Be prompt—Texas imposes penalties for late or inaccurate filings.

Permit Renewal and Compliance

Once you have a sales & use permit, it remains active as long as you file regularly. If your business closes, you must cancel the permit by notifying the Texas Comptroller’s office.

Filing Sales and Use Tax for IT Service Companies

IT service providers often deal with both taxable and non-taxable transactions. In Texas, certain digital services are taxable. Here’s how to manage sales tax compliance as an IT company:

- Identify Taxable Services: Common taxable services include website hosting, software licensing, and downloadable software. Non-taxable services often include consulting, support, and training.

- Use Resale Certificates: If you buy software or services to resell to clients, use a resale certificate to avoid paying sales tax upfront. File this certificate with vendors to keep transactions tax-free.

- Manage Out-of-State Client Sales: Sales to clients outside of Texas may not be subject to Texas sales tax. However, Texas-based IT services provided to in-state clients often require sales tax collection.

- Maintain Clear Invoices: Distinguish between taxable and non-taxable services on invoices to ensure accuracy in your sales tax records.

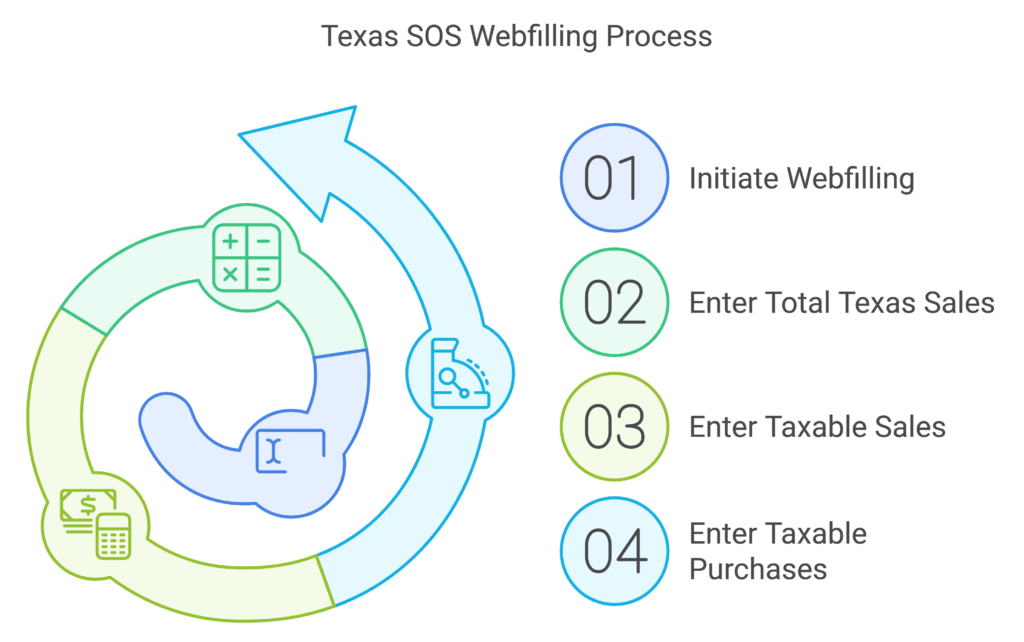

Step-by-Step Guide to FElectronically Using Webfiletronically using webfile on the Texas Comptroller’s Website

For e-commerce businesses, non-resident LLCs, and IT service companies, filing online is the most efficient method. Here’s a comprehensive guide to filing through Texas’s Webfile system:

Step 1 – Register for a Webfile Account

- Go to the Texas Comptrollwebsitebfile portal.

-

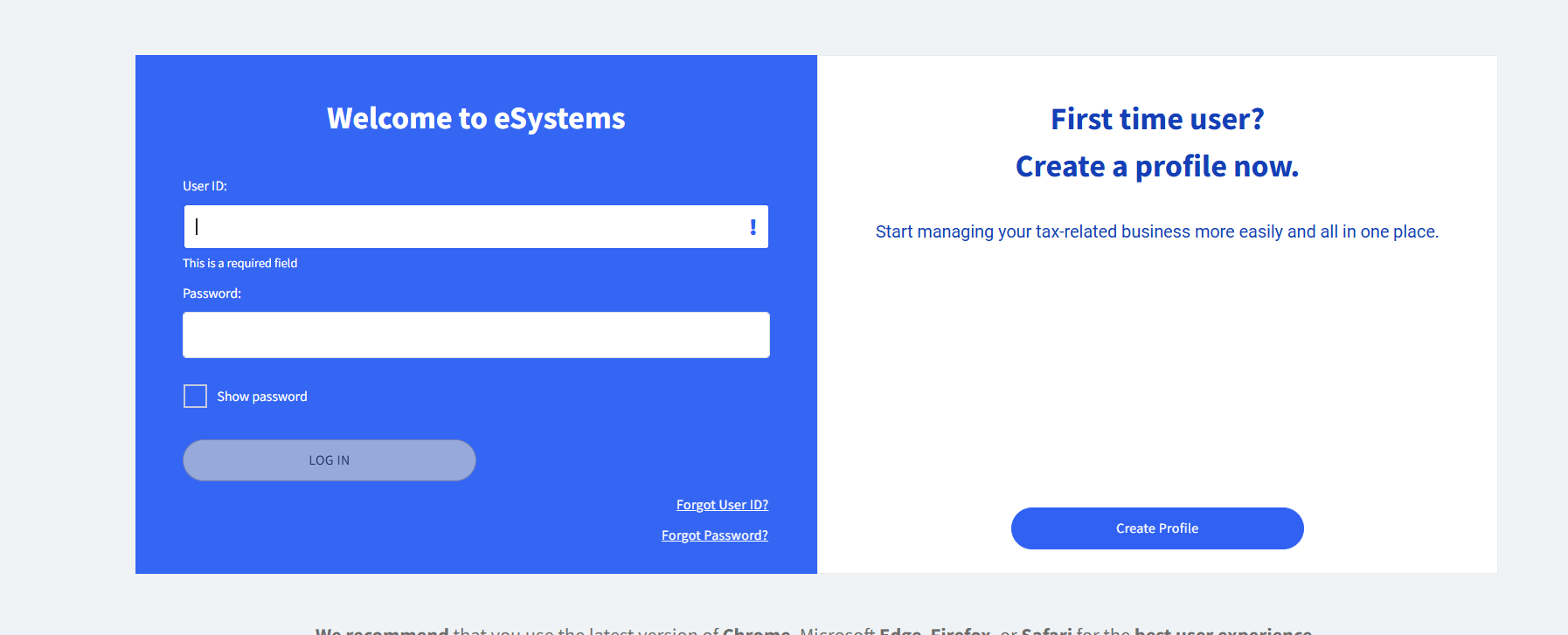

- Create a Webfile account using your taxpayer number and contact information.

- Once registered, you’ll receive a unique Webfile number for each tax type you need to file.

- Click on Web File E-systems Logins or Click here

- login with username & passwo.rd if you don’t have an account ClYou Create Profile.

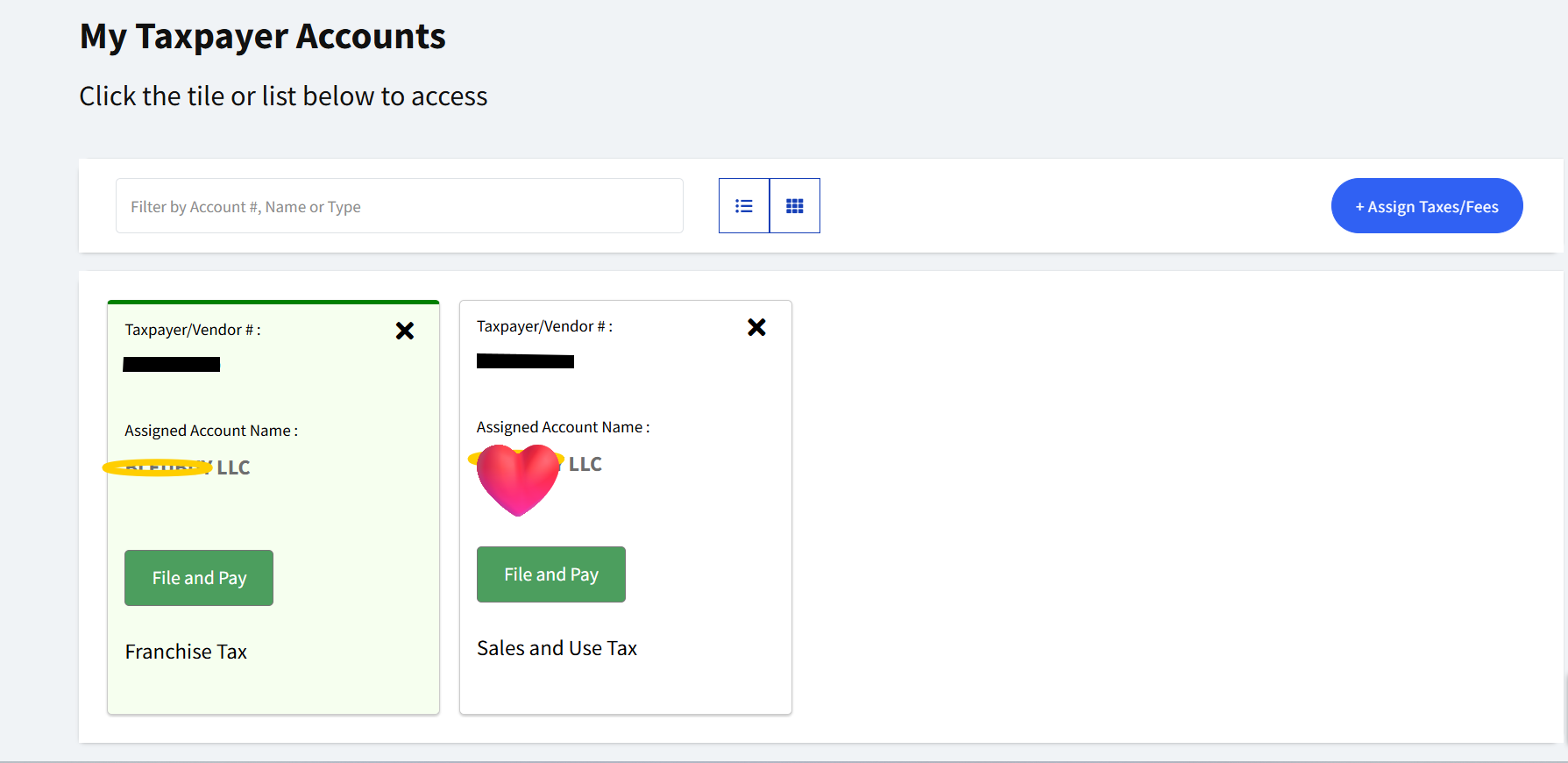

5. you will see a dathe shboard of your LLC ,with Franchise Tax & Sales & use Tax menu. click Sales & use tax to start filling.

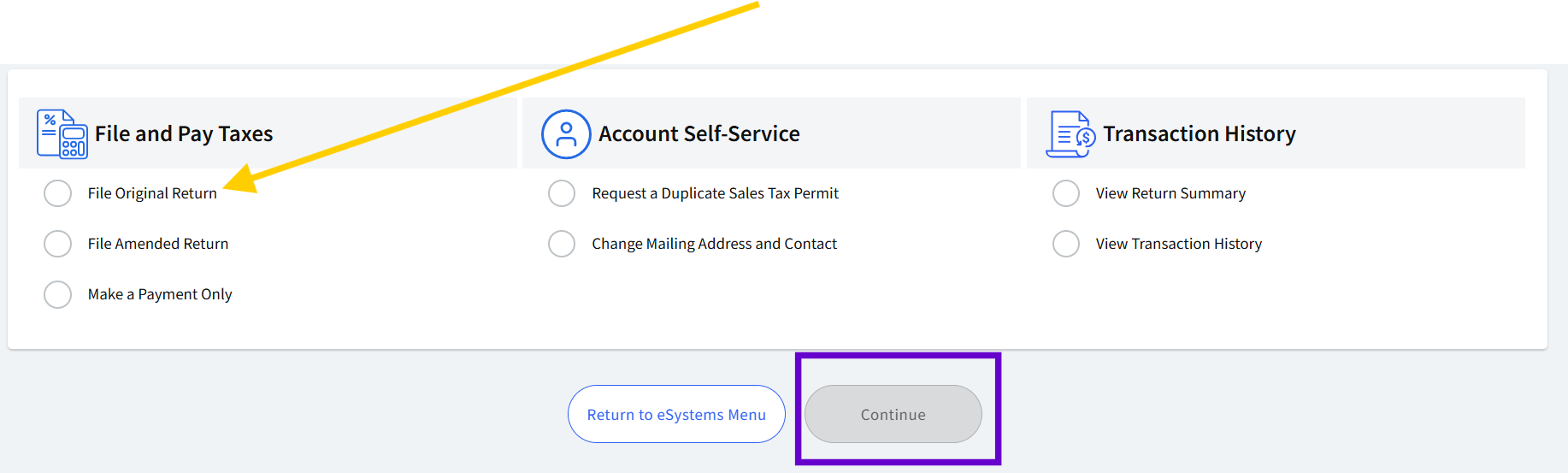

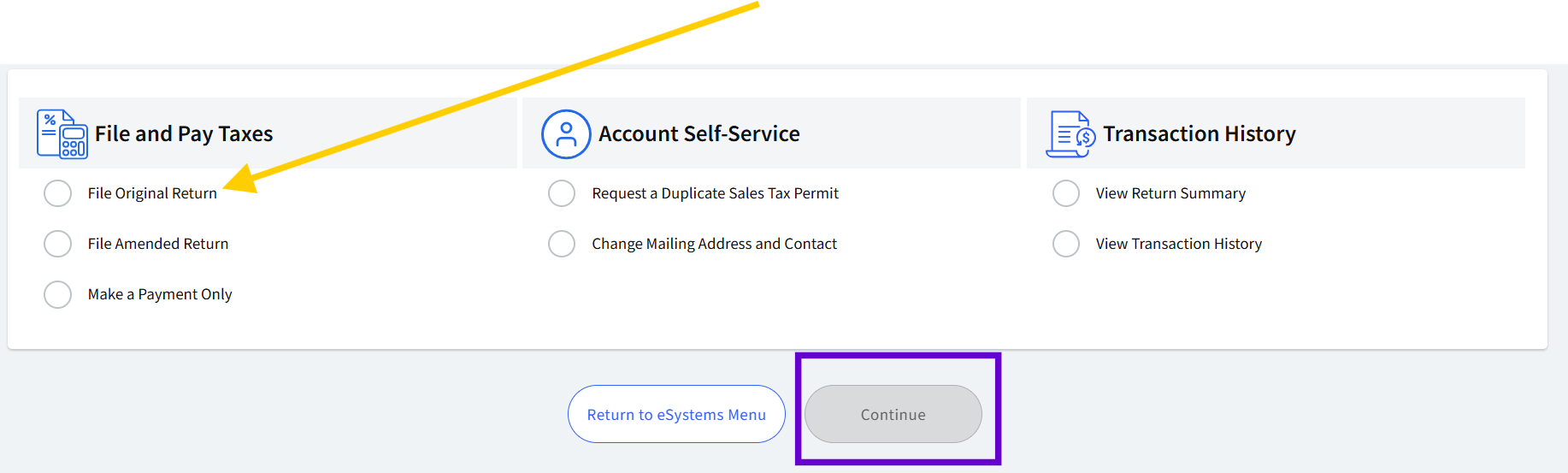

6. you will see a menu with different options to

- File Original Returns.

- Reque.st a Duplicate sales tax permit

- File Amended Return

- Make a Payment Only

- Change Mailing Address and Contact

- View Return Summary

- View Transaction History

7. Select the period that you want to start filling, you will also see previous periods & status of their fillingselect Select “File Original Return” & click ContinOn

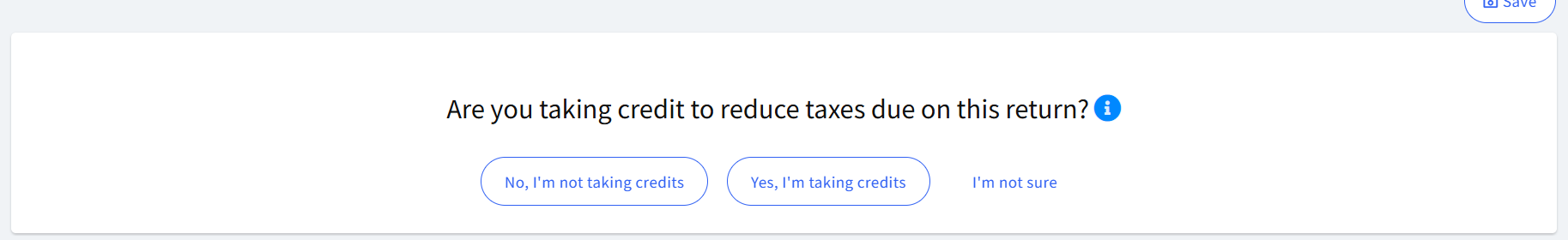

8. on the,e next page you will be asked if you have taken credit to reduce taxes due on tSelectturn. select your appropriate answer based on your situation.

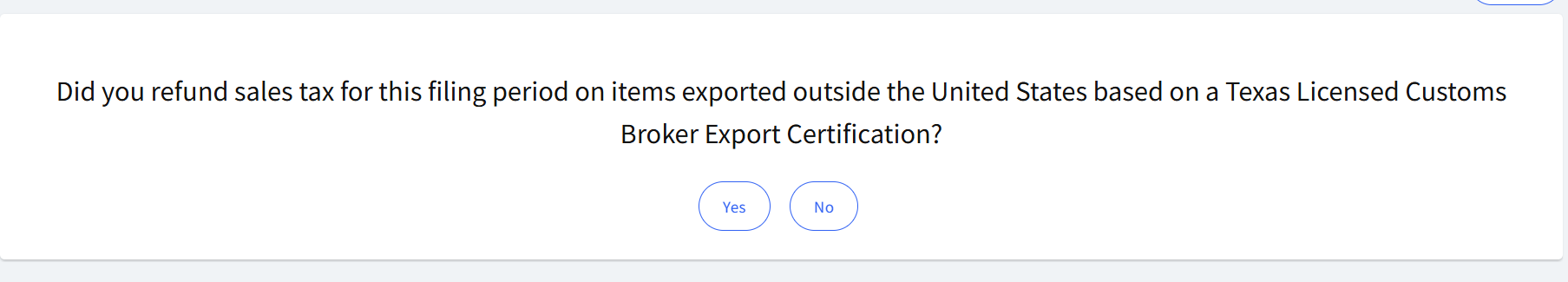

9. Custom Brokerage quesion . Did you refund sales tax for this filing period on items exported outside the UStates based on a Texas Licensed Customs Broker ExpoThisertification?

10. this step is most important while do.iHereexas SOS webfilling here you need to enter Total Texas sales & Taxable Sales and taxable purchases.

If you didn’t make any sales during the 3-month period on Amazon, your website, either E-commerce or Services you will click “Check this box & click continue if all sales are Zero ” & you will be filling Zero in all sections of Total sales in Texas, Taxable Sales & taxable purchases.

If you have collected Tax on sales made in Texas then you have to pay tax on those sales that you collected tax on the government’s behalf from your customers & have to submit to the State.

11. The last step will be a summary of your previous selection based on that you will get the amount to pay as Sales Tax & click continue.

Choose your payment method, either scheduling an EFT (Electronic Funds Transfer) or paying immediately by ACH.

Keep Documentation

Keep copies of all returns, payments, and confirmation numbers for your records. Texas requires businesses to retain these for a minimum of four years.

Filing Methods and Deadlines for Texas Sales Tax Due Dates

For non-resident LLCs and e-commerce sellers, understanding the due dates and filing frequencies is crucial for compliance:

-

-

- Monthly Filing: Due on the 20th of each month for businesses with substantial Texas sales.Mostly local businesses

- Quarterly Filing: Due on the 20th of April, July, October, and January.if the due date is a public holiday next Day will be the last date of filling.

- Annual Filing: Due on January 20th for smaller businesses meeting the annual filing threshold.

-

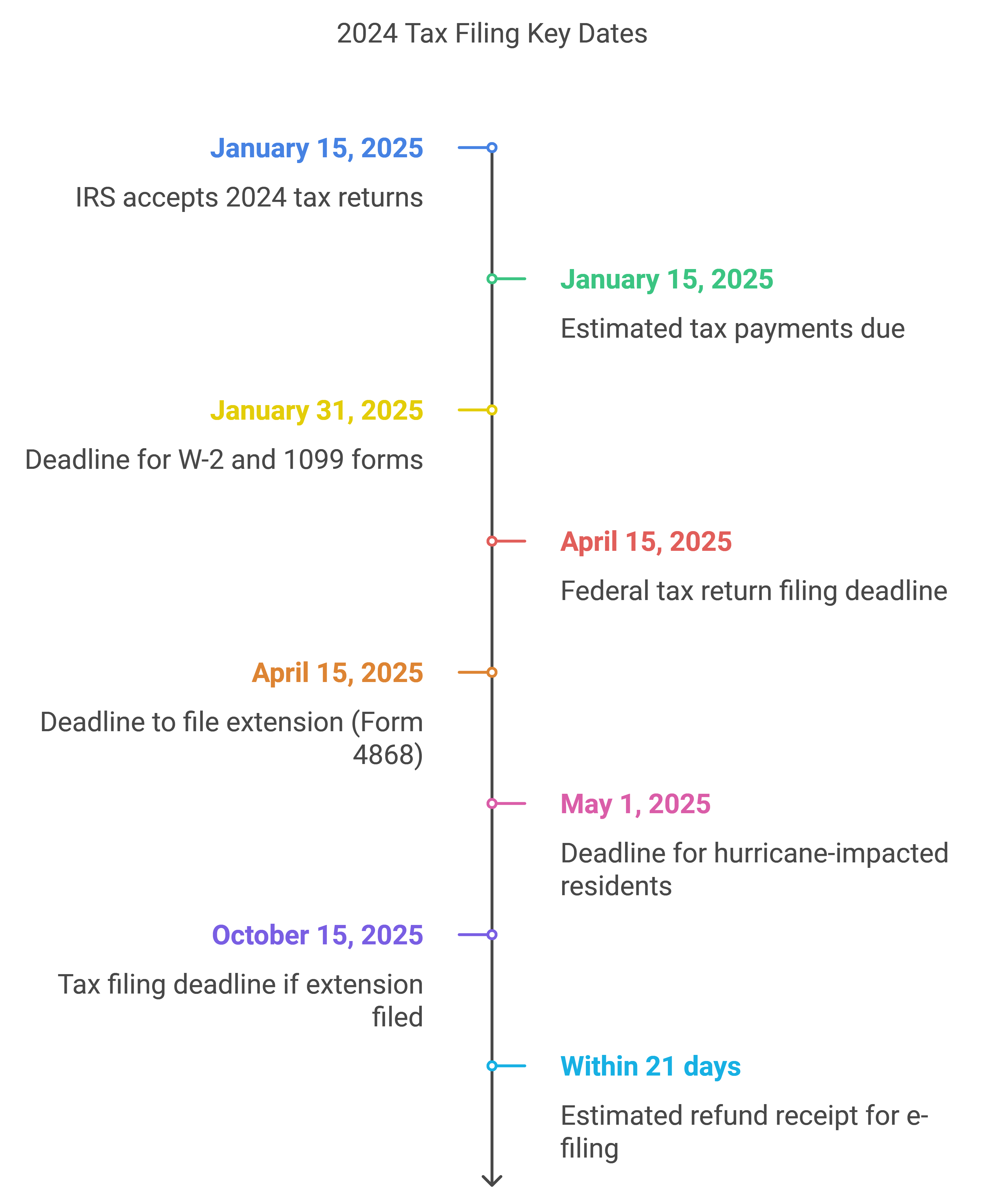

Summary of 2025 Tax Filing Deadlines

Filing by Mail

For businesses preferring traditional methods, Texas offers paper filing forms downloadable from the Comptroller’s site. However, electronic filing is faster and allows for quicker processing times and immediate confirmation.

Filing by phone

- Form 01-117: For those with no taxable sales and no tax due

- Form 01-114: For those with no taxable sales, no total sales, and no tax due

- Past due sales tax reports: For those who received an estimated billing but had no sales for that period

- Filing status changes: For those who are eligible to change their filing status from monthly to quarterly, or quarterly to yearly

To use TeleFile, you’ll need:

- Your 11-digit Texas taxpayer number

- How often do you file

- What period you are filing for

- Total sales

- Taxable sales

- Taxable Purchases

- Your telephone number

Frequently Asked Questions for E-Commerce and Non-Resident LLCs

Q1: Do I need a Texas sales tax permit if I only sell occasionally in Texas?

Q2: Can I claim Texas sales tax back if I’m an out-of-state seller?

Q3: How do I calculate sales tax for digital products in Texas?

Conclusion

Following these steps will make filing Texas sales tax easier for Amazon sellers, non-resident LLCs, and IT companies. By setting up Webfile, staying informed about city-specific rates, and managing online sales accurately, you can maintain compliance and focus on growing your business.

Ensure your records are detailed, file on time, and, when needed, seek guidance from a tax advisor for additional support. Happy filing!

FTjunction.com and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.