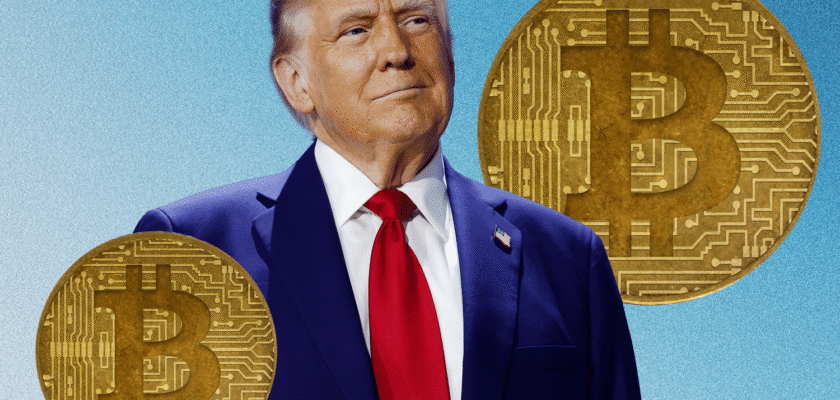

The landscape of cryptocurrency regulation in the United States is rapidly evolving, and recent developments in Washington are setting the stage for significant changes. This week, a series of crypto-related bills backed by former President Donald Trump advanced in the House of Representatives, signaling a new era for digital asset policy in the U.S.

The Legislation at a Glance

The House voted 217-212 to move forward with several key pieces of crypto legislation after a two-day blockade by Republican conservatives was lifted, reportedly following Trump’s intervention. The most prominent among these is the GENIUS Act, which focuses on establishing a federal framework for stablecoins—digital assets pegged to traditional currencies like the U.S. dollar.

The GENIUS Act is expected to be the first of the crypto bills to pass, having already cleared the Senate. If approved by the House, it will head to Trump’s desk for final approval. Other bills under consideration include measures to set market structure rules for cryptocurrencies and a proposal to prohibit the Federal Reserve from issuing a central bank digital currency (CBDC), a move strongly supported by conservative lawmakers.

Why Is This Important?

The U.S. has long lagged behind other major economies in providing clear regulatory guidance for cryptocurrencies. The lack of a unified framework has led to uncertainty for investors, businesses, and innovators in the space. By advancing these bills, lawmakers are aiming to provide much-needed clarity and stability to the rapidly growing digital asset market.

Key implications include:

- Stablecoin Regulation: The GENIUS Act would create a federal standard for stablecoins, potentially making the U.S. a more attractive market for stablecoin issuers and users.

- Market Structure Rules: New rules could define how cryptocurrencies are classified and traded, impacting exchanges, brokers, and investors.

- CBDC Ban: Prohibiting the Federal Reserve from issuing a digital dollar would set the U.S. apart from countries like China, which are moving forward with their own central bank digital currencies.

Trump’s Role and the Political Landscape

Donald Trump’s involvement has been pivotal in moving these bills forward. His administration has generally taken a more favorable stance toward cryptocurrencies compared to previous ones, and his recent intervention helped break a legislative deadlock. This support from a high-profile political figure could influence how other lawmakers and regulators approach digital assets in the future.

The close vote in the House also highlights the partisan nature of crypto regulation. While Republicans have generally been more supportive of the industry, Democrats have expressed concerns about consumer protection, financial stability, and the potential for illicit activity.

What’s Next?

If the House passes the GENIUS Act and related bills, the U.S. could soon have a comprehensive regulatory framework for digital assets. This would provide greater certainty for businesses and investors, potentially spurring innovation and growth in the sector.

However, challenges remain. The bills must still clear the Senate (for those that haven’t already), and implementation will require coordination among multiple federal agencies. Additionally, the debate over a U.S. CBDC is far from over, with strong opinions on both sides.

The Bottom Line

The advancement of Trump-backed crypto legislation in the House marks a significant milestone for the U.S. digital asset industry. As lawmakers work to finalize these bills, the world will be watching to see how America shapes the future of cryptocurrency regulation.

Stay tuned for more updates as this story develops and the future of digital assets in the U.S. takes shape.

For more insights on crypto, fintech, and policy, follow our blog and join the conversation!