Saving money for a large purchase—be it a new car, home renovation, or dream vacation—often feels like a daunting task. However, by using a strategic approach and modern tools, anyone can break down the process into manageable steps.

Whether you’re planning to make a major purchase in the next few months or years, saving over time is a smart, stress-free way to reach your goal.

In this article, we’ll cover practical saving strategies and introduce tools like Excel trackers, data analysis charts, and online goal-setting platforms to ensure your savings plan is effective.

By the end of this article, you’ll be equipped with the knowledge and tools needed to reach your financial goals and make that large purchase a reality.

Why Saving Over Time is Crucial for Large Purchases

When you’re planning for a large purchase, saving is a far better option than relying on debt.

Here are some key reasons why saving for big purchases is crucial:

Avoiding High Interest Debt

Using credit cards or loans for large purchases can lead to high-interest payments. With credit card interest rates ranging from 15% to 25%, your small monthly payments may not make much of a dent in the principal balance. By saving for your big purchase, you avoid those crippling interest rates and the associated long-term debt.

Financial Freedom and Security

When you save for a big purchase, you maintain control over your financial future. There’s no stress about monthly loan payments or worrying about your credit score. Instead, you can make purchases without any obligations, which gives you a greater sense of financial freedom.

Psychological Benefits

Finally, there’s a mental payoff when you save for something important. Reaching a financial goal like a large purchase brings satisfaction, confidence, and peace of mind. It’s also a great way to build financial discipline, a skill that will serve you well in all aspects of your finances.

How Much Should You Save for Your Large Purchase?

Before you start saving, it’s essential to define how much money you actually need to reach your goal. This involves more than just the purchase price—it’s important to factor in hidden costs and fees that could add to the total amount.

Estimate the Total Purchase Price

For example:

- Car Purchase: Research the market price of the car, including taxes, registration fees, and insurance premiums.

- Home Renovation: Add the cost of materials, labor, and contingency expenses for unexpected issues.

- Vacation: Account for flights, accommodation, activities, and other costs.

Once you have a clear understanding of the total price, you can set a realistic savings goal.

Setting Your Target Date

Next, decide when you want to make the purchase. Do you need the funds in the next 6 months, 1 year, or 5 years? Your target date will help you determine how much you need to save on a monthly or weekly basis.

Calculating How Long It Will Take to Save

To estimate how long it will take to save for your goal, divide the total amount by the number of months you have until the target date.

For instance, if you’re aiming to save $10,000 in 12 months, you’d need to save roughly $833 per month. Tools like Excel and Google Sheets can be used to track your progress and break this down even further.

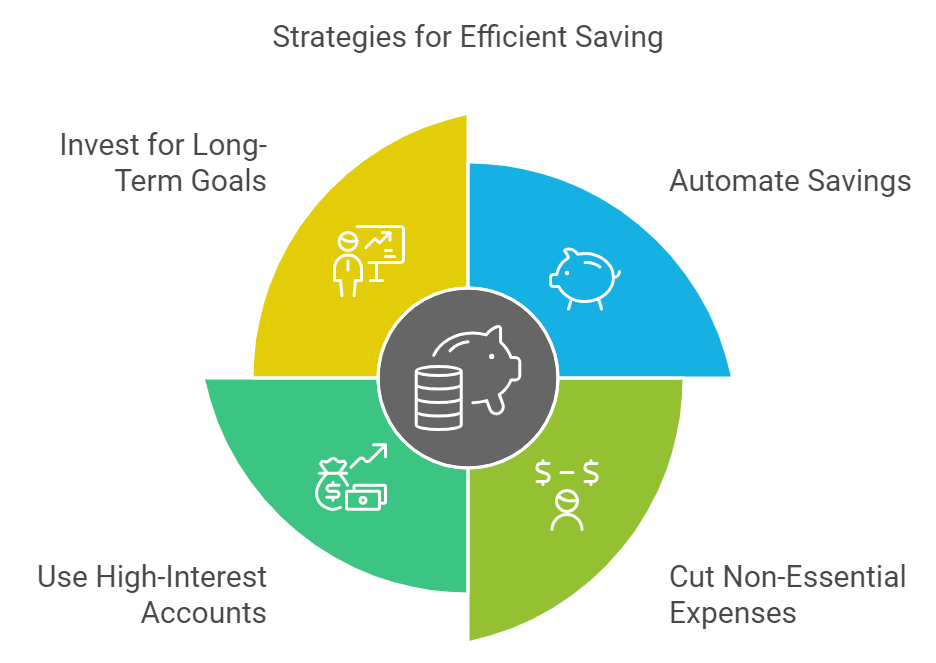

Effective Strategies for Saving Money for Big Purchases

Now that you know how much you need to save, it’s time to figure out how to put that plan into action. Here are several strategies to help you save efficiently:

1. Automate Your Savings

The easiest way to save money consistently is by automating your savings. Set up a direct deposit from your paycheck into a separate savings account dedicated solely to your large purchase. Automation ensures that you won’t forget to save, and it removes the temptation to spend the money elsewhere.

2. Cut Back on Non-Essential Expenses

Look for areas in your budget where you can cut back. For example:

- Subscription Services: Cancel any streaming services or memberships you don’t use.

- Dining Out: Reduce how often you eat out or order takeout.

- Shopping: Avoid unnecessary purchases by sticking to a shopping list and waiting 24 hours before making a non-essential purchase.

3. Use High-Interest Savings Accounts

A high-interest savings account or money market account can help your savings grow faster. These accounts usually offer higher interest rates compared to traditional savings accounts, which means your money will accumulate more over time.

4. Invest for Long-Term Goals

If your purchase is several years away, consider low-risk investments like Certificates of Deposit (CDs), Treasury bonds, or index funds. These investment options offer a way to grow your savings while taking minimal risk.

Choosing the Right Account or Investment to Save Money

When saving for a large purchase, choosing the right type of account or investment is crucial. Here are some options:

1. Savings Accounts

Traditional savings accounts are safe but typically offer lower interest rates. However, they are a good option for short-term goals (under a year).

2. Money Market Accounts

Money market accounts are similar to savings accounts but generally offer higher interest rates. They are a good choice for saving over a longer period while keeping your funds relatively accessible.

3. Certificates of Deposit (CDs)

If you know you won’t need the money for a set period, a CD can offer a higher interest rate than savings accounts and money market accounts. However, you’ll be penalized if you withdraw your funds before the maturity date.

4. Investment Accounts

For longer-term savings (2+ years), consider low-risk investment accounts. Index funds and mutual funds typically offer returns higher than traditional savings accounts, though there is some risk involved.

Online Financial Goal-Setting Tools and Websites

Tracking your savings progress and managing your financial goals is made easier with the help of online tools. These platforms allow you to visualize your goals, create budgets, and monitor your progress over time. Here are some of the top financial goal-setting tools:

1. Mint.com

Mint is one of the most popular free budgeting tools available. It automatically syncs with your bank accounts, credit cards, and other financial accounts to help you track your income and expenses. You can set financial goals for specific purchases, and Mint will help you stay on track by categorizing spending and showing where you can cut back.

2. YNAB (You Need A Budget)

YNAB is another budgeting tool that’s ideal for goal-setting. It’s designed to help you prioritize your spending and create a savings plan. YNAB’s “Goal” feature lets you set targets for your large purchase and track your progress.

3. Simple Bank Goals

Simple Bank offers a unique way to save through its “Goals” feature. You can create individual goals (like saving for a new car), set a target amount, and track your progress with real-time updates. It’s perfect for users who want to save consistently without worrying about excessive fees.

4. Personal Capital

Personal Capital provides an all-in-one solution for budgeting, saving, and investment management. The platform helps you track both your spending and your savings progress. It also offers a retirement planning tool, which can be helpful for setting long-term goals.

5. Goalscape

Goalscape is a web-based tool that helps you set, track, and visualize your goals. It uses a visual interface that allows you to break down large goals into smaller, manageable steps. This tool can be particularly useful for saving for large purchases, as it lets you see how each small step contributes to your overall goal.

Tracking Your Progress with Excel

For those who prefer to manage their finances manually, an Excel savings tracker can be extremely helpful. Here’s a simple way to create your own savings tracker:

- Create a new sheet with columns for:

- Date

- Amount Saved

- Total Savings

- Notes (for any changes in your savings plan)

- Add a simple formula to calculate your total savings as you add to the tracker.

- Use conditional formatting to highlight when you reach milestones or are behind target.

This Excel tracker provides a clear visual of your progress and can easily be adjusted based on your needs.

Saving money for a large purchase doesn’t need to be overwhelming. By setting clear goals, using online tools, and staying disciplined with your saving strategies, you can achieve your financial goals without resorting to loans or credit cards. Remember to automate your savings, cut back on unnecessary expenses, and choose the right account or investment for your timeline.

With the right plan and tools, that dream purchase will be within your reach before you know it. Start today, and take control of your financial future!