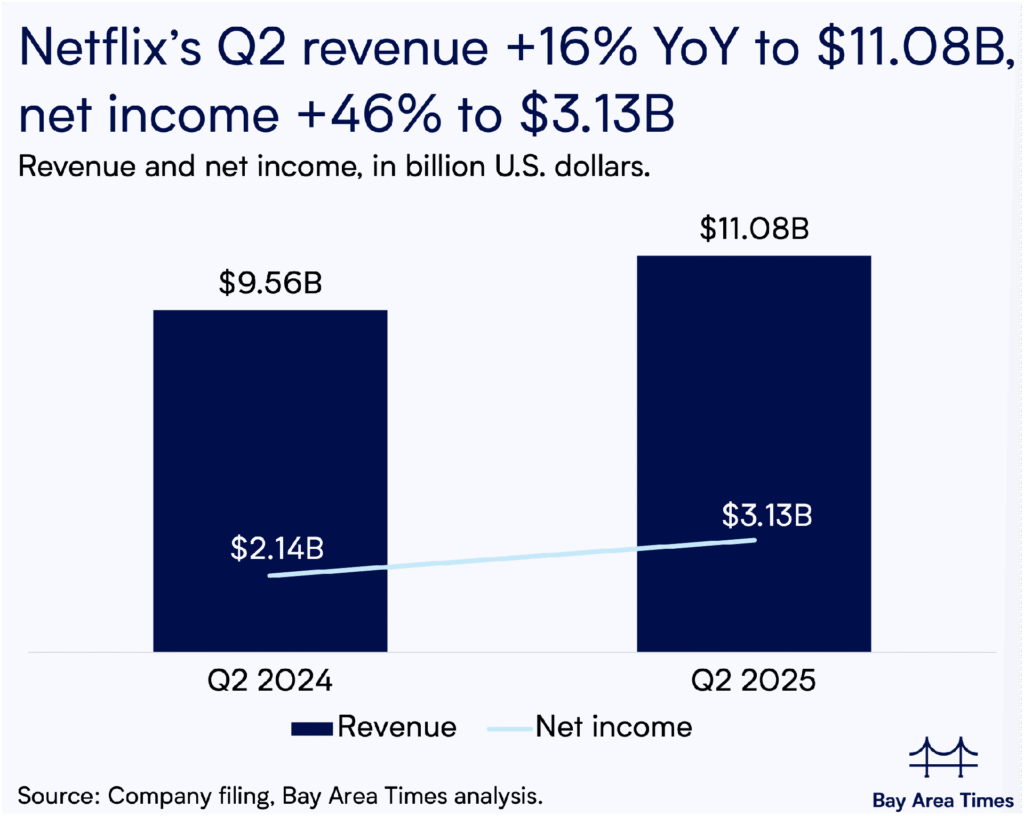

Netflix just delivered another blockbuster quarter! In Q2 2025, the streaming giant reported a 16% year-over-year revenue increase, hitting $11.08 billion, while net income skyrocketed 46% to $3.13 billion. With over 95 billion hours streamed and a bullish outlook for the rest of the year, Netflix is rewriting the rules of digital entertainment—and Wall Street is taking notice. The company’s stock price has doubled in the past year, adding a staggering $250 billion in market value. What’s fueling this momentum, and what’s next for Netflix? Let’s dive into the numbers and trends shaping the future of streaming.

Netflix Q2 2025 Financial Highlights

- 16% YoY revenue growth to $11.08B

- Net income up 46% to $3.13B

- Comparison with Q2 2024: $9.56B revenue, $2.14B net income

- Key drivers: subscriber growth, content strategy, pricing power

Updated Full-Year Guidance and Q3 Outlook

- Raised full-year revenue guidance to $44.8B–$45.2B (up from $43.5B–$44.5B)

- Q3 2025 sales expected to grow 17.3% YoY

- Factors influencing guidance: global expansion, ad-supported tiers, password sharing crackdown

Streaming Metrics and User Engagement

- 95 billion hours streamed in 2025

- Engagement trends: top shows, regional growth, user retention

- Impact of original content and global hits

Netflix Stock Performance and Investor Sentiment

- Stock price doubled in the past year, adding $250B in market value

- Market expectations: 6.5% swing after Q2 results

- Analyst reactions and future outlook

What’s Fueling Netflix’s Growth?

- Content investments and global originals

- Expansion of ad-supported plans

- Technology and personalization

- Competitive landscape: Disney+, Amazon Prime Video, others