A person’s ability to Manage money directly affects his or her chances of survival and advancement in society. People with basic financial management skills will find it easier to live a stable life than others, and these skills will come in handy when they enter society in the future.

These Modern Days, Foks don’t plan before spending. Big Malls & outlets are common these Days & we never forget what brings us here & buy 60% of the stuff that we don’t need.

Write down every sum of money you spend, analyze it every week, see what money should be spent and what is unnecessary, and then remind yourself to avoid excessive consumption next week.

Keeping an account of what you are spending not only helps us remember where we spent and organization but also lets us understand that efficient consumption is reasonable consumption.

When you have surplus money in your hand, you should learn how to make your money appreciated. You can try to learn some investment knowledge. When you have accumulated some investment knowledge, you can try to buy a small amount of funds bonds, or even stocks. As for how to choose, it depends on your interest. Either stock exchange Crypto Currencies or mutual funds.

The purpose of financial management is not only to let you save a lot of money and let money rise but also to make your future life more secure.

How to Save Money

We all need money. We all want to have unlimited money & Super rich. We all want to make a fortune. We have heard all of our life from our ancestors that Money doesn’t grow on trees. it doesn’t attain easily.

below are several ways to Save Money.

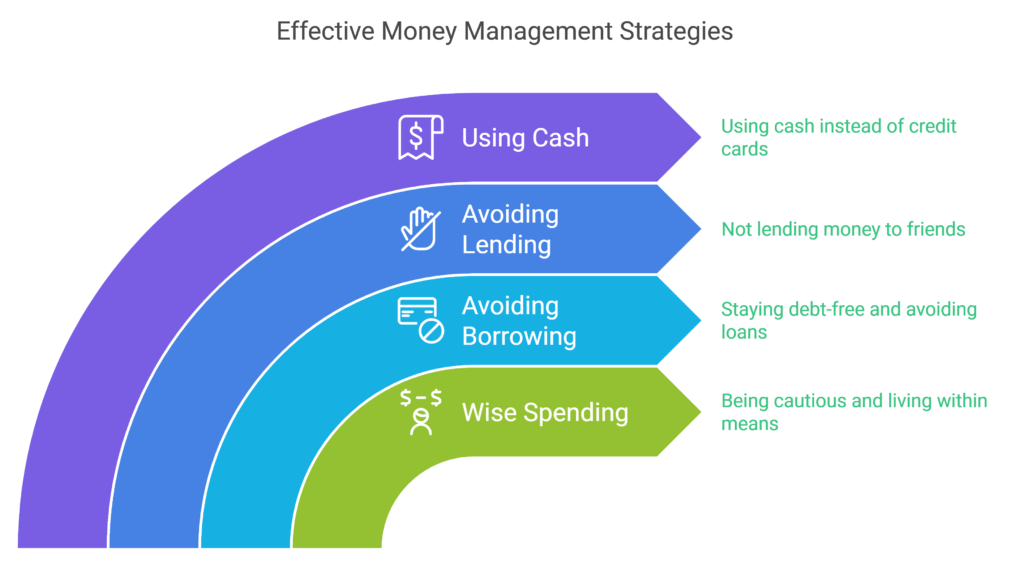

Be Wise with Your Money

Don’t be a borrower

Don’t be a personal Lender.

Never lend money to others..If you ever Lend your money to friends, You will lose your friend.

Lend only in case of emergency. Lend only if the need is reasonable. If your friend asks for one hundred, lend him twenty & forget about it. don’t expect a return if he/she returns its good if not you lost only $20 not $100

Use Cash to Shop

buy things with cash, and, use cash to shop. Avoid using credit cards. When you count physical money & handover it over to cashiers at a shop you feel for it. while using the credit card you don’t feel like spending hard-earned money. you seem braver when it comes to credit cards while cash is difficult to spend.

COVID-19 draws attention & gives a boost to Card Payments due to health issues people face during COVID-19. Governments are also encouraging the masses to adopt Card payments to have a check & discourage cash economic activities

Avoid those interest payments. Never spend your money before you have it. Never buy things you cannot afford. Try to do without credit cards.

Wise words when it comes to spending

Buy only what you need.

Don’t buy what you want.